History of Silver Prices – From Ancient Times to Today

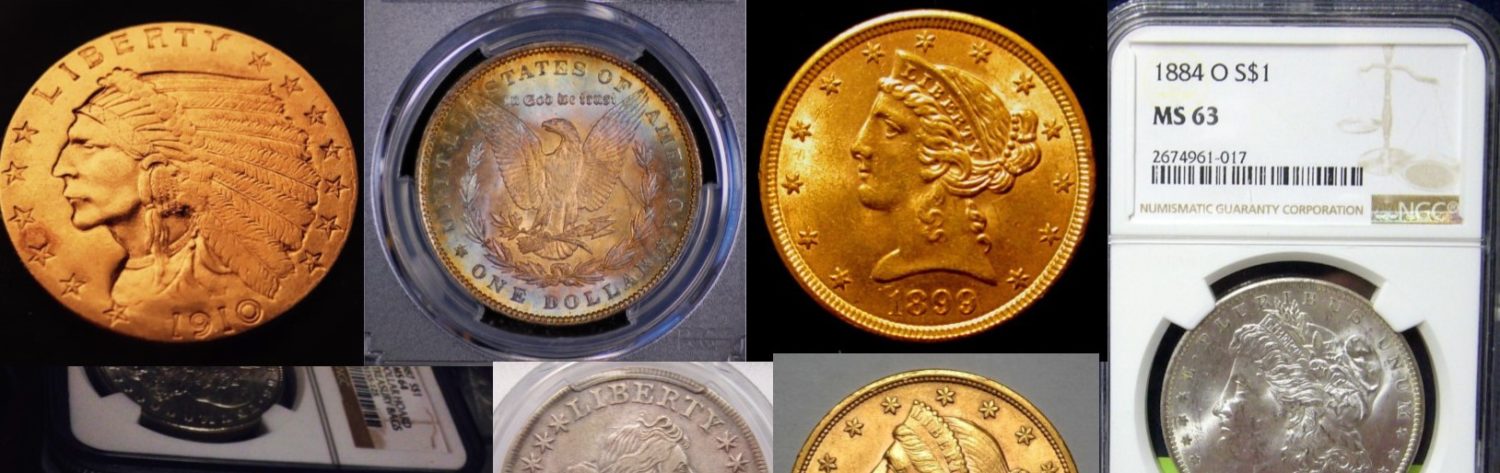

I meet a lot of people that purchase and sell silver coins based on the current silver spot price instead of any numismatic values that the coins may hold. There is nothing wrong with that – I can actually see why it would be interesting to track silver prices so closely just as you would any publicly traded stocks that you own. People that do this will typically buy and sell junk silver coins, American Eagles, foreign silver coins, and so on.

As a long time collector with no plans of selling any coins that I have, I typically don’t track spot prices on a daily basis. I probably should not say this, but, on occasion I like to see drops in the silver spot price because typically that relates in a softening of silver coin prices which translates to me being able to buy more!

CommodityHQ did a very interesting article about two years ago about the 2,000 year price history of silver. Daniela Pylypczak-Wasylyszyn does a great job giving an in-depth overview of the history of silver prices. I have copied this article for you below. At the time of this posting, the price of silver has dropped about 50% since this article was written. For a current silver spot price, look at one of the trackers above this paragraph.

Daniela Pylypczak-Wasylyszyn Jun 24, 2015

Pricing Silver

Given that for so much of human history silver was used as money, it can be challenging to talk about its historical price. To a certain extent, it’s like talking about the value of a $5 bill in terms of $1 dollar bills. In any case, an examination of prices throughout history shows inexorable inflation, both as the supply of gold and silver increased and as governments increasingly debased their coinage and/or turned to paper money.

While silver is more common than gold, it’s not exactly common. The USGS Silver estimates that 23,100 metric tons of silver were mined around the world in 2011. That compares to the 2,700 or so metric tons of gold that were mined, and the 323 million metric tons of iron ore mined by a single company, Brazil’s Vale (VALE), in the same year. Curiously, that 10:1 ratio between silver and gold shows up again and again. For example, the estimated global reserves for silver (530,000 metric tons) are roughly 10 times those of gold (51,000 metric tons). It’s also well worth noting that of all the silver mined in the history of mankind, an estimated 25% has been mined since 1975 and about two-thirds has been mined since 1900.

Ancient Prices

Before delving into the discussion of silver’s historical value, a few starting points are important to understand. First, it’s difficult to compare modern and ancient labor, as much of the labor in ancient times was performed by slaves. Secondly, the translation of “laborer” or “craftsman” into modern terms is imprecise at best. The same goes for concepts such as the length of a normal workday. In the same vein, prices can be skewed by the more primitive state of trade; modern conveniences like wine and spices were quite expensive in medieval England, but part of that is due to the fact that they weren’t produced in England and long trade routes and/or wars took their toll on prices.

Going back to ancient Babylon, we know that workers earned the equivalent of about 2.1 grams of silver per day (approximately 1/15 of an ounce or a little more than $2 in today’s silver prices). At that time, the price of a sheep ranged from 2.6 g to 16 g of silver (about $2 to $16 in today’s prices), which compares to recent prices of about $90 to $120.

Apparently, it was better to be a laborer in ancient Greece, as typical wages were about 1 attic drachma (4.3 g of silver) in the fifth century and about 2.5 drachmai by 377. In the fifth century, a drachma would buy you approximately 3 kg of olive oil and three drachmai would buy you a medimnos of wheat (about 54 liters). While the price of that medimnos climbed to 5 drachmai by the fourth century, a day’s labor would still buy approximately two weeks’ worth of food for one person (if they lived on bread alone).

The Romans may have brought many valuable inventions to the world, but debasement and serious inflation are inventions that humanity probably could have done without. Although the Roman day wage of 1.2 denarii (4.2 g of silver) was consistent with wages during the time of the Greeks, there was huge inflation and debasement from the time of Nero through Diocletian and beyond. As the Romans gutted the silver content of the denarius from 3.5 g of 98% silver to 3.4 g of 94% silver on down to 40% and then almost nothing, the price of a “measure” of wheat soared by about 15,000 times over about 250 years.

The Medieval Times

While the medieval period saw a pronounced increase in trade and the growth of cities, it was also marked by wars and plagues that significantly depopulated large swathes of Europe. In many cases, depopulation led to pressures for higher wages and the nobility often fought back with wage controls.

Around 1300 AD, a laborer in England could expect two earn about 2 pounds sterling in a year, or about 672 g of silver (approximately 2.1 g of silver per day, given the different workweek of medieval times). Likewise, we know a thatcher in 1261 could look to earn about 2 pennies a day or 2.8 g of silver. Thatchers’ pay increased to about 3 pence (approximately 4.2 g of silver) in 1341, 4 pence in 1381, and 6 pence in 1481. Along the way, a city “craftsman” could look to earn about 4 pence a day in the 1350s.

So what would those wages buy? In the early 14th century, wine cost between 3 pence and 10 pence per gallon in England, and two dozen eggs could be had for 1 pent. Some time later, an axe cost about 5 pence in mid-15th century England, while wheat cost approximately 0.2 g of silver per liter (not much different than the per-liter price in ancient Greece).

The Industrial Age

By the 18th and 19th centuries, the use of paper money was increasingly common alongside silver and gold coins. What’s more, the price of gold and silver were increasingly fixed and stable for long stretches of time. Sir Isaac Newton fixed the price of gold in 1717, and it pretty well stayed at that price (excluding the years of the Napoleonic Wars) until World War I.

Likewise, the price of silver more or less stayed at $1.30/oz from the founding of the United States through the Civil War. Prices were exceptionally turbulent during the Civil War (rising to nearly $3/oz) and stayed above $1.30/oz until the late 1870s. Prices generally declined through the latter years of the 19th century, dipping below $0.60/oz in 1897, mostly hovering in the $0.50s through to World War I. From a low of about $0.25/oz in 1932, silver generally climbed thereafter, moving to above $0.70/oz after World War II, past $0.80/oz in 1950, and crossing $1/oz in 1960.

Silver jumped alongside gold throughout the 1970s and spiked to $50 an ounce in January of 1980 as the Hunt brothers, Nelson and William, manipulated silver in an attempt to corner the market. Silver crashed shortly thereafter, hitting $8 in 1981, $6 in 1986, and dropping below $4 in the early 1990s. Silver has since rallied through the late ’90s and the first decade of the 21st century, currently sitting at about $33 an ounce.

Tracing the path of wages, the average wage was approximately $1 per day in the latter part of the 19th century, or approximately 25 g of silver. In 1914, when Henry Ford revolutionized the auto industry (and how companies viewed wages), offering $5/day (about 10 oz of silver), the average daily wage was $2.34 per day.

When federal minimum wages began in 1938, the nominal value of those wages were about $2/day (or more than 4.5 ounces). Those wages climbed to about $16 per day in 1974 (about 3.6 ounces of silver) to $58 today (or about 1.75 ounces of silver). Said differently, today’s minimum wage buys about 13 times the amount of silver that the average daily wage in ancient Greece bought.

The Future

Silver’s value throughout history has always been volatile, as the supply of labor, foodstuffs and consumer goods waxed and waned with wars, trade growth and technological innovation. Given how modern governments view monetary policy as something of a panacea, it seems like ongoing inflation is a pretty safe bet.

It is worth asking whether the price of silver stacks up as fair. For more than 2,000 years, somewhere between 1/10th and 1/15th of an ounce of silver bought a day’s labor; in today’s terms, that would suggest that silver should trade for $264, if U.S. wages are the global standard. By way of comparison, minimum wages in China’s Guangdong province (an area with extensive manufacturing activity) would work out to $6/day on average, or about 5.6 g of silver – about half the wages in 4th century Greece. It really is a case of what is considered to be the representative global wage [see also Doomsday Special: 7 Hard Assets You Can Hold In Your Hand].

It is also interesting to see that the value of gold today is more than 50 times that of silver, even though the actual ratio of production and global reserves suggests that such a spread is at least three times wider than it should be. In any event, investors should continue to expect silver prices to be volatile and inconsistent, irrespective of whether governments start pursuing sounder monetary policy.